The transfer of debtors' cases will take place through a cession (purchase and sale of debts). The information on the site will be presented in encrypted form. The innovation of the project consists in the use of a multi-factor scoring model that assesses the debtor's condition at the time of the acquisition of its debt, taking into account the totality of its obligations.

For the seller of debt portfolios. All buyers only from the register of debtors, mandatory KYC on the site

By joining the offer. Just sign one page

A detailed auction report can be used for audit and tax purposes

A personal Manager accompanies the Bank, the seller and the buyer throughout the transaction

The only independent platform for which Auctions are the main business enforced by scoring model

Customer satisfaction survey for signing, paying, and transferring assignments. Customer ratings

Electronic database of buyers

Buyers from the EU and the whole world

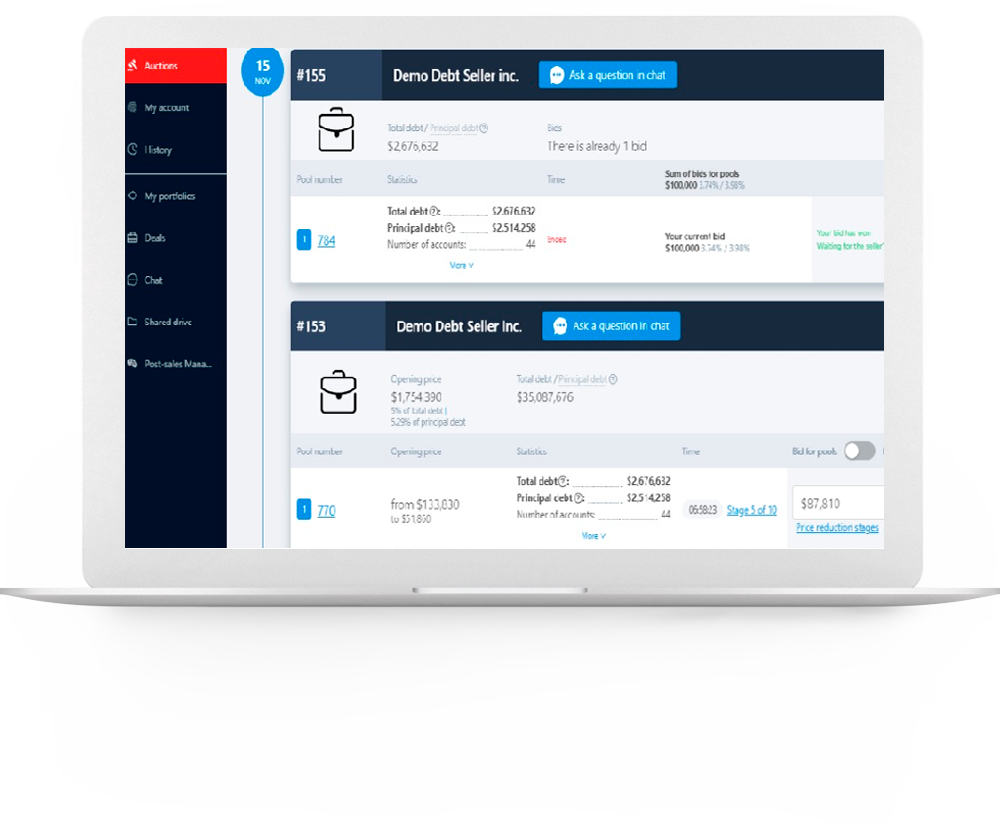

English type, Dutch, Auction of closed offers

the transparency of the deal organized online – as now the deals are at the moment limited by the conservative nature of the debt sale process

getting the service of a legal transaction without bureaucratic delays

the opportunity to purchase the debts of a debtor who is already present in the portfolio, to consolidate the maximum number of obligations in one hand

the opportunity to work with industry areas, accumulating debts in a particular sector

obtaining an independent assessment of the debtor according to the scoring model of the site

the ability to sell debts in which the seller is not interested at the best rate, receiving offers from interested buyers

a convenient mechanism for working with a portfolio of debts, with an automation of loading and unloading the register

Expertise: Andrey has the great experience in the bank field, started as client and credit manager, for the last ten years taking the position as a Vice-President of Retail Bank in Russia. Andrey was always involved in multicultural atmosphere working also with problem assets of banks.

Expertise: Roman was always focused on business development field with more than 26 years’ experience of selling bank products and customer support in b2b and b2c. As well Roman had great possibility to develop his knowledge and experience of bank transfers systems. The Roman’s knowledge of Italian language can be useful for the project and his role in it.